Finding someone to step up into the role of Treasurer can sometimes be a difficult task. The candidate needs to be able to wrap their head around a lot of numbers. They need to be detail-oriented. They need to be task masters. They need to be able to pull up any report having to do with transactions, deposits, check cashing, check writing, profit and losses, budgets, taxes, reports for your audits, the list goes on. Volunteers often feel too overwhelmed or underqualified to step up for this position. Membership Toolkit makes the role of treasurer much easier and more efficient. We work with thousands of parent/teacher organizations and have assisted many treasurers in using our software over the years.

Responsibilities for a PTA Treasurer are structured and procedural and thus not hard to learn. As a bonus, once you set everything up, our software makes it so that the department almost runs itself. Even if you inherit a financial mess, we can help you get control and keep your sanity all year long. Plus, you’ll be in great shape to transition to a new treasurer next year.

Qualities of a Treasurer

Do you have what it takes to be your organization’s treasurer? Chances are you already exhibit these qualities and those you don’t are easy to learn.

Be Trustworthy

This is the number one trait a treasurer should have. Being trustworthy means you’re dependable and honest. Others can count on you to be objective and do the right thing.

Be Impartial

The best treasurers are always able to separate their personal feelings about a person or project from their professional, legal duties. They can analyze facts and make impartial decisions based on what’s best for the organization.

Feel Comfortable Working with Numbers

A good treasurer will be comfortable with numbers. You don’t have to have a special degree in accounting or bookkeeping to hold this position. As long as you’re responsible and a good steward of your group’s monies, you’ll succeed.

Be Willing to Explain Figures

It’s important to be transparent with your members and offer frequent updates about bank accounts, expenses, and the budget.

Bank Money as Quickly as Possible

Establish a set rule to deal with cash and checks coming from your members. You don’t want to carry around large amounts of money so deposit it as quickly as possible. Make sure to have deposit supplies or online banking set up ahead of time. Go a step farther and collect as much money as possible through your Membership Toolkit site. This will not only reduce your trips to the bank, it will take out the middle man handling the money by making all of the deposits electronic and automatic; safer for you and your organization.

Keep Clear Records for Board Turnover

Make it your mission to leave the treasurer’s “office” in better shape than when you arrived. By keeping an eye on quality all year long, you’ll serve your group well this year and into the future. Who knows, you might even like the job enough to run for reelection! If you don’t though, our Accounting Software makes it easy for future treasurers to either view reports you ran and kept in the site’s electronic file cabinet, or pull any reports they need to see. It’s easy to filter based on date range, items sold, etc.

6 Things Treasurers Need to Know

Before your predecessor leaves, ask him or her for these key pieces of information.

1. Your PTA's Tax ID Number

This is formerly known as the Employer Identification Number (EIN). If your organization does not have one, you can file Form SS-4 (Application for Employer Identification Number) with the IRS.

2. Bank Account Number

Your best bet is to apply for an EIN from the IRS and then open a bank account under that number. It is not recommended to use your school’s tax ID for a bank account. In addition, it can cause tax problems if a bank account is opened with a member’s social security number so keep those things separate.

3. Tax Exempt /501(c)(3) Status

Section 501(c)(3) is a portion of the U.S. Internal Revenue Code (IRC) which says certain organizations, including parent groups, can earn tax-exempt status. If you aren’t sure if your PTA is registered, just call the IRS. Your group should have a determination letter from the IRS indicating your status.

4. Sales Tax Exemption

Exemption varies from state to state. Check with your state’s treasury department for specific sales tax exemption information.

5. IRS Contact

The Internal Revenue Service (IRS) has a really helpful website with sections dedicated to charities and nonprofits. They have a dedicated call center for non profit taxes at 877-829-5500.

6. Past Tax Returns

The annual tax return required by the IRS for 501(c)(3) organizations is the 990/990EZ form. If your organization is a 501(c)(3) group, you should have copies of past 990s on file. If you can’t find any in your files and you’re certain your PTA has 501(c)(3) status, it’s a good idea to call the IRS to find out whether your group has been negligent in filing the form.

Setting a Budget for Your PTA

Budgeting is a valuable tool in any business, and in volunteer-led organizations, it is absolutely essential. Preparing and executing a budget is an important part of your organization’s ability to put forth its mission. Forming a budget committee will ensure you get all the help you need with this important task.

Look at Last Year's Budget

Review last year’s budget and activities and compare it to proposed expenses and activities for the upcoming year. If you are doing a lot of the same thing, set your budget at slightly above last year’s to account for inflation.

Predict Incoming Money

What are some ways your organization has raised money in the past? Do you have a traditional event like a fun run that you do every year? Take time to look over your income from the past two or three years to get a good idea of what will come in the for the year. Don’t forget to include your membership fees in addition to fundraising. This is a good time to analyze what worked and what you should repeat, and what maybe wasn’t worth the time and expense.

Set Up a Reserve

It’s important to set some money aside each year in case fundraisers don’t go as planned. This is a great time to revisit budgets of the past and learn lessons from any pitfalls. If your organization has major financial commitments at the beginning of the financial year, it makes sense to plan some carry over from the previous year.

Budget Approval

Depending on your type of organization and what is put forth in your bylaws, you’ll need to gain approval of the budget from your board and possibly your general membership. It can take place at the end of the previous year or the beginning of the new year.

Create a report to send your budget to your members ahead of your first meeting. Also have some printouts available. Allow for discussion and be prepared to explain each item and the board’s thinking about each amount.

Once everything is discussed and everyone is comfortable with the document, a motion will need to be made to adopt the budget. Make sure it is recorded in the meeting minutes and that the secretary has an official copy.

A budget should be adopted before any business is conducted in the new financial year.

Changing the Budget

Budgets are not typically set in stone. They are a plan to measure up against. If you have a fundraiser that went surprisingly well, you’ll need to look at how to spend the unanticipated income. Alternatively, if expenses came out higher than expected, other parts of the budget may need to be cut back in order to balance out.

Check your bylaws for guidance on changing your budget. Sometimes the board is able to reallocate without membership permission. Other times, it may be necessary to get permission from members. This can be done with a motion at the general meeting and must be noted in the minutes.

Meeting Motions for Treasurers

Have you ever wondered if you’re making the right motions at your general meetings or if you should be making motions at all? ‘Robert’s Rules of Order’ are used to ensure your organization can get business done in a timely manner. That being said, no one is going to nitpick minor technicalities or call attention to technical errors. You shouldn’t be nervous about bringing forth motions. Here are two that need to be made at each meeting. If you bring forth these motions as the treasurer, you’re good to go!

"I move to allow payment of ordinary and necessary bills during the period from ___ to ___, not to exceed budget."

This motion allows the treasurer to pay the bills as they come in, as long as it doesn’t exceed the budget and the events have been approved as part of your organization.

"I move to ratify paid bills, check number___to___, in the total amount of $___.”

This motion ratifies the bills and checks you have already written. Have a printed list of checks or share a report from your accounting software so members can see what has been spent and what is coming up.

The list should show who was paid, what the payment was for, the amount, the check number and the date.

Safeguarding Your PTA Funds

Take these steps to manage your money correctly and be transparent with your members.

- Make sure checks are signed by two people.

- Incoming money should be counted by two people, one of whom should be the treasurer.

- Volunteers should never take money home to count it.

- Keep track of the funds you expect to receive from automatic store donations, box top programs and similar sources, and note when you expect to receive them. Make sure they have been deposited into your PTA’s account.

- Make sure you receive your cancelled checks from the bank. The auditor should verify that there are two signers on every check.

- Someone besides your treasurer should review all bank statements. It’s a good idea to take a quick look at the check endorsements to make certain that the correct person cashed the check.

Mistakes Treasurers Make

As the treasurer, you have a big job and a lot of responsibilities. Don’t let these common mistakes keep you from accomplishing your organization’s goals. Here are three mistakes we see a lot and how to avoid them.

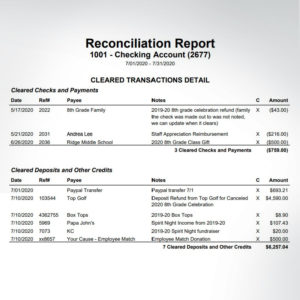

Treasurers Not Performing Bank Reconciliations on a Timely Basis

A bank reconciliation compares transactions in your accounting records against your monthly bank statement. It is a somewhat easy task to complete if it’s performed promptly each month.

A monthly reconciliation helps you:

- Keep track of how much money you really have available in your bank account against which future checks can be written.

- Catch errors accidentally made when recording information in the checkbook ledger or that the bank may have made.

- Make sure that all the transactions have been entered in your ledger accounts.

- Detect any fraudulent activity happening on your account such as any unauthorized checks, withdrawals or transfers being made out of the account.

- Identify old items in need of additional research like old outstanding checks that have not yet cleared the bank.

Treasurers Closing Accounting Books in Error or Prematurely

At the end of each fiscal year, it is necessary to perform your organization’s year end close for the accounting books. As a result, each income and expense ledger account will be reset to zero so that each will begin the new fiscal year with a zero balance.

Some treasurers make the mistake of closing the year in error (ie. any time other than year-end). If the books are closed by accident, say mid-year, then you will only have partial year financials for the transactions that have occurred to date and not a complete financial record for the full year.

The other year-end closing mistake treasurers make, is performing the year end close too early. You do NOT want to complete your year-end close until after you’ve finished entering ALL transactions for the entire current fiscal year. Once the accounting books are closed, you cannot reverse the process and all new entries will be tagged to the new fiscal year. For example, if you issued a check in the previous fiscal year but forgot to record it prior to closing the accounting books, the check (expense) will need to be entered in the new fiscal year’s ledger accounts. This will cause the current year’s financials to be misrepresented with an expense that took place in the prior year.

Membership Toolkit Tip

Remember, the balances in the ledger accounts will be reset to zero upon closing, so it is very important to make sure to print or download all the financial reports for the fiscal year prior to closing. It is recommended to print Budget vs Actuals, Income & Expense report (in detail), and the 990-EZ information report.

Treasurers Not Understanding the Difference Between Different Types of Accounts

To begin setting up an accounting system, the very first thing that needs to take place is the creation of a chart of accounts. The chart of accounts is a listing of the accounts that are used for recording transactions into the general ledger. In order to be set up correctly, it is important to understand the different types of accounts included on a chart of accounts.

There are four main types of accounts that make up the Chart of Accounts: assets, liabilities, income, and expenses.

Asset Accounts

These are the accounts that the organization owns that have value. Examples of assets are cash, checking account, savings or money market account, PayPal account, petty cash, or undeposited funds. Assets that a business owns can also include computers, land, buildings, vehicles, equipment, and inventory.

Liability Accounts

These are the company’s financial obligations or the money the business owes to others. Examples of a liability account are accounts payable, and money collected that is owed to someone else like sales tax due or membership dues.

Income Accounts

This is the money the organization earns from selling its products or services. Examples of income are money received for events or fundraising, donations, money from the sale of school supplies, spirit wear, interest income or fees charged.

Expense Accounts

This is money the organization spends in order to produce the goods or services that it sells. Examples are the cost to purchase supplies or spirit wear, or expenditures the company makes in order to operate such as rent, office supplies, utilities, repairs, and salaries.

The chart of accounts is the cornerstone of the accounting system. By taking the time to setup the accounts in the correct category, you will facilitate the accurate financial record-keeping of the organization.

Getting Started

As your school year or financial year begins, you’ve hopefully attended a treasurer training through your state PTA or local HOA or nonprofit resources. Follow these steps to start off on the right foot.

- Obtain all financial records and materials from your predecessor.

- Change the signature cards for your PTA or other organization’s bank account to reflect the new signers, as authorized by your bylaws and elections.

- Hold a budget committee meeting and carefully plan a proposed budget to serve as a financial guide for the year.

- Present the proposed budget to the executive board for approval.

- At the first association meeting of the year, present the proposed budget for adoption.

As your year continues, keep these important tasks in mind:

- Issue a receipt for all monies received by your organization. If there is no financial secretary, promptly deposit funds in the bank account.

- The budget is not an authorization to pay bills. Bills must be presented to the association or the executive board for approval before payment, or ratified according to procedures in the unit bylaws.

- Send your payments of membership dues through the appropriate channels. If you are a PTA, you may only keep a portion of dues.

- Be certain that two people count all monies and both sign the cash verification form.

- Every check should have two signers.

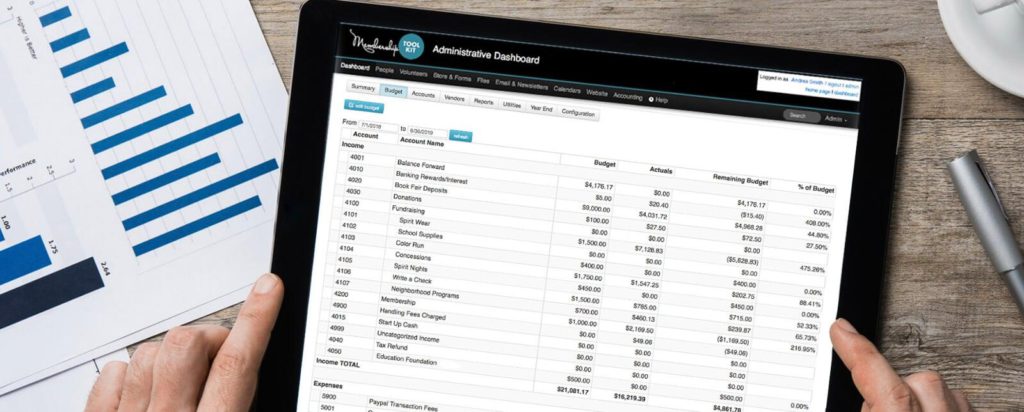

10 Reasons Your Treasurer Needs Our Online Software

Stepping into the role of treasurer can sometimes be a daunting task. Volunteers often feel too overwhelmed or underqualified to step up for this position. Membership Toolkit makes the role of Treasurer much easier and most importantly, accurate and efficient with these top reasons.

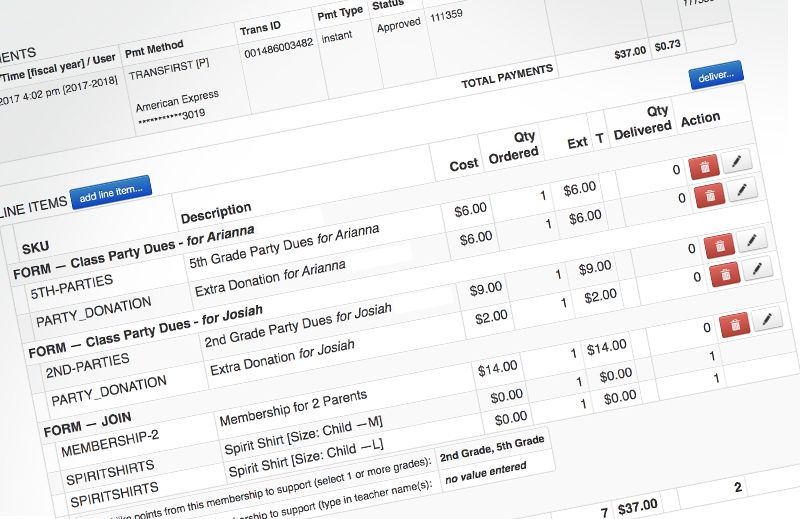

1. Complete Integration With Your Order Processing System

Our system automatically allocates funds to the appropriate income ledgers so that income does not need to be manually categorized. Set up your products and income accounts and the system automatically creates the journal entries to recognize income accordingly.

2. Choice of Payment Processors

Our accounting tools are seamlessly integrated with a choice of payment processors, allowing you to choose the option most appropriate to your needs.

3. Your Parent Organization Applies Sales Tax When Applicable

If you are selling something that is taxable, the system automatically calculates and tracks that cost for you.

4. Chart of Accounts Specific To Your Parent Organization

Accounts are easy to set up, modify and maintain. You are easily able to grow with your organization.

5. Your Treasurer Can Easily Print Checks

You can track the checks you write and even choose to print them directly from your system.

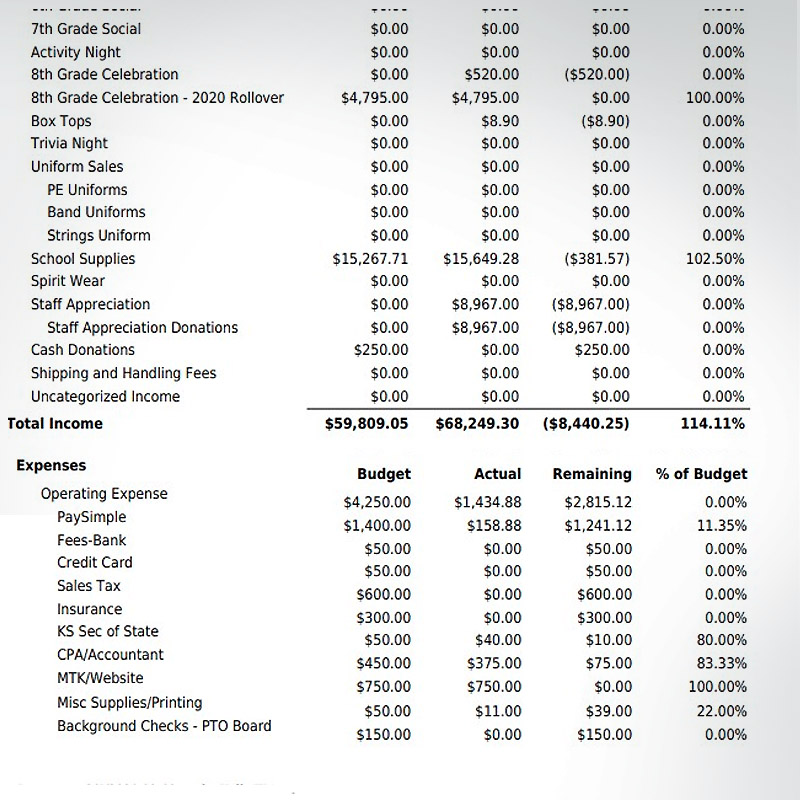

6. Keep Your Board On Track With Easy To Use Budget Reports

See (and share) your budget as well as your current financial position with just a click of a button. Creating the correct report is a breeze.

7. Reconciliation Each Month is A Breeze

Our reconciliation tool makes this important monthly task easy to accomplish so there is no reason not to stay up to date!

8. Reports That Are So Easy To Generate, They Practically Write Temselves

If you are responsible for your organization’s finances, then reports are vital. Many reports can be viewed or downloaded as Excel files or PDFs, ready for reporting to your board at any time. Whether it’s income reports, budget reports, transaction reports, income and expense reports, or something else, we’ve got you covered.

9. An Online System So Highly Configurable, It Is The Perfect Fit For Any Organization

Our Accounting Tools can be modified to best suit the needs of your organization–estimation of processing fees, offline payments, pass-through fees, shipping and handling fees, and sales tax can all be configured to meet the needs of your organization.

10. Customer Support

Our unmatched customer support is worth its weight in gold. We will help you with any questions and make sure that your treasurer is supported throughout the year with helpful links, webinars, tutorials and help tickets.

Filling a board can always be a bit of a struggle. With Membership Toolkit, you don’t need an accountant to be your treasurer. You can fill that position with the promise that your volunteer will be supported along the way and you can feel secure in knowing it will all be in one place, under one umbrella, and done correctly.